does texas have an inheritance tax 2019

Compute 2019 taxable income in each of the following independent situations. Thats why we created this resource so you can talk to one of our tax accountants for free.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

In cases where you owe state inheritance taxes those are specifically excluded and cannot be claimed as a deduction.

. The average cost of a funeral is 7133 and medical expenses related to dying hover around 12750. I believe the answer is some of both. Inheritance taxes in Iowa will decrease by 20 per year from 2021 through 2024.

By this time you have probably long forgotten about your utility deposit. The majority of Estates take around 6 to 12 months. Ask your tax questions here and we might choose them to publish on this page.

Drew and Meg ages 40 and 41 respectively are married and file a joint return. Hawaii taxpayers have seen tax burdens increase by 12 percentage points from 116 to 127 percent between 1977 and 2019. Further the executor may need to pay estate and inheritance taxes.

Florida does not have personal income estate or inheritance taxes. If you move out and the utility company does not have a forwarding address or for some unknown reason on their end are not able to get you your deposit back they are required by law to turn it over to the state. This case study has been adapted from PPCs Tax Planning Guide Closely Held Corporations 32d Edition March 2019 by Albert L.

Employers also need to pay reemployment tax at the federal level through FUTA contributions. For those subject to this tax the executor has nine months to file a tax return with the option to obtain a further six-month extension. Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013.

Sybil age 40 is single and supports her dependent parents who live with her. And since 1977 Arkansas taxpayers have gone from some of the least taxed at 94 to an above-average tax burden at 104 percent. For assistance with the application process or to request a mailed application call Texas.

Reemployment tax in Texas has a minimum tax rate of 031 percent and a maximum rate of 631 percent. Check back often to see if new questions have been answered. The decedent had a gross estate plus federal adjusted taxable gifts made within two years of their death worth more than 425 million.

Barry Johnson and Lewis A. But here at Keeper Tax were on a mission to make them simpler for people who arent tax professionals. Known as El Ratón he inherited his fathers operation and his.

The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012. Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

Interest ratesthe price of moneyhave been unusually low for most of this century particularly since the 2008 crisis but going back to Greenspans era. 1 online tax filing solution for self-employed. Americas 1 tax preparation provider.

Inheritance tax is typically paid by the estate. Over two years back in October 2019 Mexicos Guardia Nacional attempted to arrest one of them. The State Bar of Texas presents the information on this website to help lawyers improve the quality of legal services they offer their clients and to educate the public about the law.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Published by Thomson ReutersTax. As of 2019 any estate valued below 114 million escapes federal estate taxes.

Employers need to pay Texas UI tax on the first 9000 that each of their employees makes in a single calendar year. Property tax exemptions include a homestead exemption of up to 50000 and those available to older adults over age 65 and for the disabled. Articles published on Texas Bar Today represent the authors perspectives and not a position or viewpoint by the State Bar of Texas.

The son then 29 more than deserved arrest. Therefore that amount does affect eligibility for cost assistance and Medicaid. A Vermont estate tax return must be filed if either situation prevails.

Although Vermont does not have an inheritance tax it has a flat estate tax of 16. Iowa has no estate tax but unlike many other states it does have an inheritance tax of up to 15. Was it purely a policy choice or the result of larger less-controllable economic forces.

In United States tax law there is a distinction between an estate tax and an inheritance tax. Savings arent counted when determining Medicaid or Cost Assistance. Inheritance tax estate tax and death tax or duty are the names given to various taxes that arise on the death of an individual.

A straightforward estate with no property to sell and a single bank account may take as little as 3 months. The former taxes the personal representatives of the deceased while the latter taxes the beneficiaries of the estate. Texas seniors can apply online for Medicaid at Your Texas Benefits or submit a completed paper application which can be found here.

Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022. In addition to four dependent children they have AGI of 125000 and itemized deductions of 27000. A Except as provided by Subsections f i-1 and k the assessor for each taxing unit shall prepare and mail a tax bill to each person in whose name the property is listed on the tax roll and to the persons authorized agent.

Floridas corporate income tax rate was increased back to 55 as of Jan. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. The wisest people I know differ on exactly why.

El Chapos son Ovidio. In Texas unclaimed money is turned over after one year.

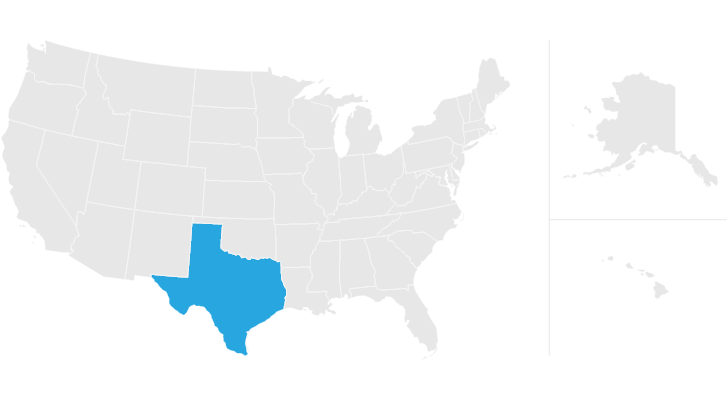

Texas Estate Tax Everything You Need To Know Smartasset

How To Avoid Estate Taxes With A Trust

How To Avoid Estate Taxes With A Trust

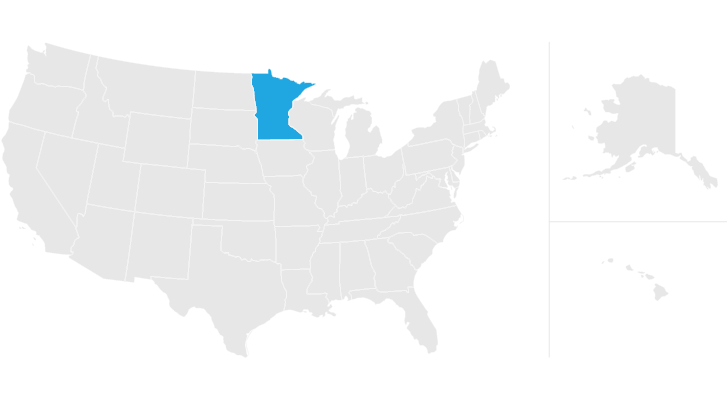

Minnesota Estate Tax Everything You Need To Know Smartasset

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

States With An Inheritance Tax Recently Updated For 2020

Recent Changes To Estate Tax Law What S New For 2019

How Is Tax Liability Calculated Common Tax Questions Answered

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With An Inheritance Tax Recently Updated For 2020

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Recent Changes To Estate Tax Law What S New For 2019

Texas Estate Tax Everything You Need To Know Smartasset

Federal Estate And Missouri Inheritance Taxes Legacy Law Missouri

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

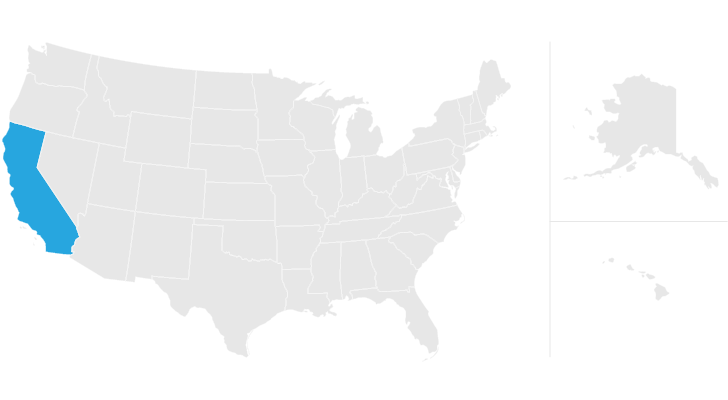

California Estate Tax Everything You Need To Know Smartasset

Kentucky Estate Tax Everything You Need To Know Smartasset

State Death Tax Is A Killer The Heritage Foundation

Here S Which States Collect Zero Estate Or Inheritance Taxes